Welcome to

First Fidelity Brokerage

a PCF Insurance Services Company

We are excited to have you here

If you are just browsing and are looking to learn more about the company, we hope that you find what you are looking for.

If you are an existing client (or their representative) and are looking to request a certificate of insurance, to file a claim, or another service request, please call us,(212) 933-9050 x0 for operator, chat online, or click on ContactUs for additional options.

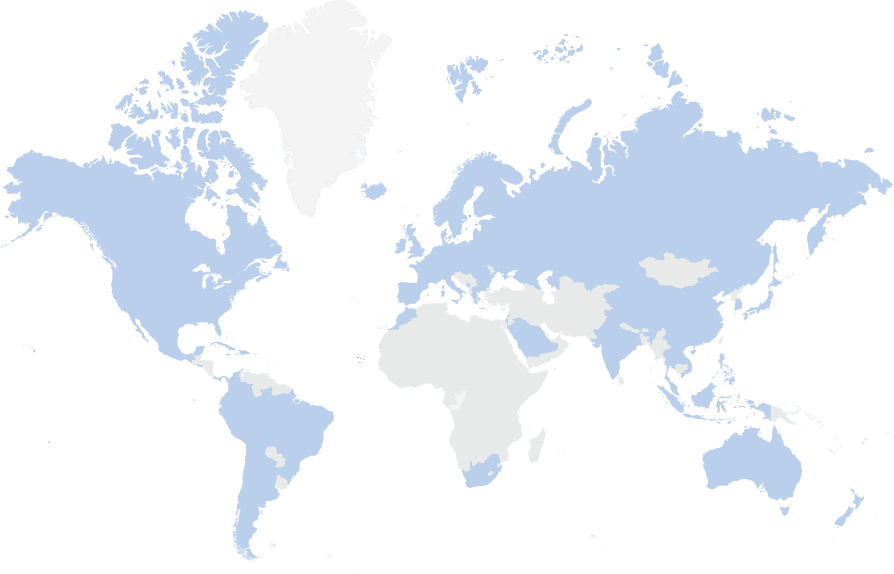

FFB is an insurance agency and risk consultant, founded in 1994, servicing businesses and non-profit organizations (throughout the globe, but mostly in the USA). On June 1st, 2020, FFB joined PCF Insurance Services which provides a broad array of property & casualty, life and health, employee benefits and workers’ compensation insurance products. With access to over 1,500 insurance carriers, we also have binding authority from several leading insurers for a select group of industries. While we help companies manage risk from virtually all industries, ranging from healthcare to financial services to transportation, we have a niche focus on Education, Construction and Real Estate. Particularly if you fall into one of these sectors and are exploring insurance options for your organization, go ahead and contact us, and let’s see if you qualify for any of our programs.

About the Company

Over 25 Years Experience in Commercial Insurance

First Fidelity Brokerage is a full service property & casualty insurance buyer, providing insurance contract procurement and risk management services to commercial and non profit organizations.Read More

Products and Services

FFB offers its clients contractual transfer of risk via procurement of insurance policies, claims management and risk management, services which are provided by seasoned professionals, driven by data and supported by leading technologies.

Specialized Industries

Insurance for K-12 Schools and Higher Education Institutions

We specialize in serving the unique insurance brokerage needs of Charter Schools, Private Schools, Colleges and Universities. Serving over 30,000 students nationally!

We offer coverages for:

- Colleges and Universities

- Vocational/Trade Schools

- Private

- Public

- Charter Schools

Our Non-Profit Organizations Insurance is Tailored to Your Specific Business Needs

Non-profit organizations have very specific needs that must be met when obtaining insurance coverage. Because most organizations operate on government or agency funding, they have specific insurance requirements and a limited budget. FFB understands their constraints, thus, we are able to deliver a cost-effective solution that is tailored to their needs without loss of services or coverages. We offer services to a spectrum of organizations including:

- Family Foundations

- Educational

- Religious

- Cultural and Artistic

- Health & Human Services

Construction Insurance Specialists

Construction has its own unique and special requirements. FFB provides focused expertise to assist businesses in dealing with complex issues that confront the construction industry. Our experts can help design programs that fit the risks and preferences of contractors. Having access to admitted and non-admitting carriers allows us to offer broader and more comprehensible options. Businesses we service include:

Construction Insurance Brokers of:

- General Contractors

- Artisans

- Residential Home Builders

- Concrete and Masonry Contractors

- Elevator Companies

- Crane Contractors

- Electricians

Insurance for Technology Driven Companies

FFB understands the needs of technology companies to feel secure while they innovate and evolve. We offer protection for their most valuable assets, creativity and innovation, with specialized insurance solutions tailored to fit their needs. Because the industry is constantly changing, we understand how important it is to be knowledgeable and anticipate their rapidly changing risk. We offer services to:

Technology Insurance specialists for:

- Military Technology

- Telecommunications Companies

- Information Technology Companies

- Medical Technology Companies

- Electronic Manufacturing Companies

- Web Based Businesses

- Technology Driven Advertising Agencies

Insurance for Private Equity and Financial Institutions

The current economic turmoil along with global credit crisis are among the events changing the financial landscape. With these increased challenges, FFB understands how important mitigating these risks can be for the financial industry. We offer consultative services and risk transfer strategies that can help them deal with these challenges head on.

- Hedge Funds

- Investment Banks/Retail Banks

- Alternative Investment Firms

- Credit Unions

- Private Equity

- Venture Capital

- Broker/Dealers

- REITS

Real Estate Insurance Specialist

FFB specializes in providing risk management and insurance coverage tailored to the real estate community. We provide sophisticated risk management solutions to owners, operators, property managers, housing authorities and investors throughout the region. We offer customized strategic tools and programs that can help our clients manage their risk effectively.

Insurance Consolidation for OwnersIf you own or control multiple properties, speak to us about potential consolidation opportunities. We can provide you with a proposal for a consolidated program that includes the following benefits:

- Pricing – Utilize the purchasing power of your entire portfolio to get significant price reductions

- Coverage Terms – Make the terms and conditions of the insurance program consistent across your portfolio

- One Renewal/Expiration Date – Think about insurance only once a year, free your time to do other things

- Loss Control – Receive more carrier loss control services

- Claims Handling – Receive better claims handling and claim payouts

Special Programs

If you are a broker looking to access any of these programs, please email Alex Novoselski at anov@ffbinsurance.com

News & Announcement

All News-

Small Business Insights – How to Prevent Employee FraudJordan April 5, 2023

Employee fraud—when an employee knowingly lies to, steals from or deceives their employer to make personal gains—occurs in approximately two‐thirds of U.S. small businesses, according to the National Federation of Independent Business. In fact, small businesses face a higher risk of employee fraud than large corporations. This is often due to a lack of basic accounting controls and a higher degree of misplaced or assumed trust. While employee fraud can take place in many forms, the following are the most common types:

-

Loss Control Tips – Towing OperationsJordan January 9, 2023

Owning and operating a towing business can be a very rewarding experience. After all, towing operations can help clear the road of damaged or disabled vehicles in a

timely and effective manner when unexpected incidents occur. However, in addition to the risks common in every industry, towing businesses face unique liabilities due to the movement of vehicles and the presence of large, heavy equipment. That’s why it’s vital to establish effective loss control measures. This resource outlines common risks

towing operations must address and offers helpful strategies to avoid possible claims. -

Loss Control Tips Paving Contractors: Asphalt and ConcreteJordan December 12, 2022

Asphalt and concrete paving contractors construct surfaces for residential and commercial properties, such as roads, sidewalks, driveways and concrete floors. More specifically, concrete paving contractors build, resurface and repair highways, roads, parking lots, airport runways and bridges using a mixture of sand, gravel and/or crushed stone. Asphalt paving contractors produce and apply asphalt—which may also be referred to as hot-mix asphalt, asphalt concrete or asphalt paving mix—to various surfaces, including roads and parking areas. Due to their wide variety of operations, these

professionals are often exposed to various safety, liability and property risks. That’s why it’s vital to have effective loss control measures in place. This resource outlines common risks paving contractors must address and offers helpful strategies to avoid possible claims. -

Construction Risk Advisor – December 2022Jordan

Severe weather conditions can be detrimental to job sites, placing additional strain on construction employers. While there’s no way to completely safeguard worksites from the elements, there are measures that can be taken to reduce the risks posed by extreme weather events. Such weather can come in many forms, each of which require their own preparations in order to protect job sites. Before preparing their worksites, it’s important for construction employers to understand the severe weather conditions most likely to affect them, which can vary based on season and location. Possible extreme weather conditions can be broken down into the following general exposures: